Financial Crises

Should the Federal Reserve Reveal More about Its Stress Test Models?

Greg Feldberg, director of research at the Yale Program on Financial Stability, argues that the Fed already discloses more than any other authority in the world about its stress test models and warns that revealing more could repeat mistakes made in the run-up to the Global Financial Crisis of 2008-09.

We Need Better Data for Better Crisis-Fighting

The market crash sparked by the COVID pandemic exposed the weaknesses in the financial data we collect, writes Greg Feldberg of the Yale Program on Financial Stability. Better financial data would enable more targeted efforts and better ex-post analysis.

Is it Time to Shut Down the Fed’s COVID Stimulus Programs?

Prof. Andrew Metrick, director of the Yale Program on Financial Stability, says that the four emergency lending programs recently shut down by Treasury Secretary Steven Mnuchin are an insurance policy that may be badly needed in 2021.

Holding Up a Mirror to the First Global Stock Bubble

Yale SOM’s William Goetzmann, an expert in art and finance history, showed us satirical prints documenting the first global stock bubble, three centuries ago.

Can Government Contain the Economic Crisis?

Prof. Andrew Metrick, director of the Yale Program on Financial Stability, says that fighting a crisis is different from economic policymaking in normal times; governments need to be exceptionally generous and not get bogged down in stringent processes that keep money from getting to those in need.

A Federal Program Is Supposed to Keep Midsize Businesses Afloat. Why Isn’t It Reaching Them?

Yale SOM’s William English explains how the Main Street Lending Program fits into the array of federal stimulus efforts and offers proposals for making it work better.

Faculty Viewpoints: The Economic Policy Response

In an online conversation, Yale faculty members discussed the steps already taken to prevent the COVID-19 crisis from turning into economic catastrophe, and the need for more effective healthcare policies.

Faculty Viewpoints: Preventing a Financial Crisis

In an online event hosted by the Bank for International Settlement, Andrew Metrick, director of the Yale Program on Financial Stability, discussed the actions that governments have already taken to prevent the COVID-19 pandemic from sparking a full-blown financial crisis, and the challenges still to come.

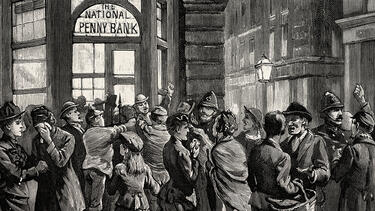

Narrative Economics: How Stories Go Viral

Nobel Prize-winning Yale economist Robert Shiller examines how the stories we tell about our lives and our society can spread from person to person, changing shared perceptions of events and shaping economic behavior.

Three Questions: Prof. Andrew Metrick on Paul Volcker’s Legacy

Paul Volcker, former chairman of the Federal Reserve, died on December 8 at age 92. Prof. Andrew Metrick reflects on Volcker’s contributions to the Fed and economic policy.

To Prevent Financial Crises, Regulate Short-Term Debt

Yale SOM’s Gary Gorton argues that financial crises happen because short-term lending, while essential to the economy, is also vulnerable to panic when parties lose confidence in each other. In a new paper, Gorton proposes a method of regulating short-term debt and preventing future crises.