Three Questions: Prof. Andrew Metrick on Paul Volcker’s Legacy

Paul Volcker, former chairman of the Federal Reserve, died on December 8 at age 92. We asked Andrew Metrick, professor of finance and management at Yale SOM and an expert on financial stability and systemic risk, to reflect on Volcker’s contributions to the Fed and economic policy.

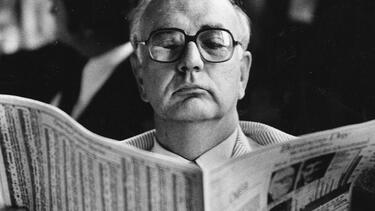

Federal Reserve Chairman Paul Volcker before a hearing in August 1980. Photo: James K. W. Atherton/The Washington Post via Getty Images.

What was Paul Volcker’s key insight when he became Fed chair in 1979 and raised interest rates?

The “solution” of high interest rates was easy to see. The hard part was to actually do it. Volcker was willing to be unpopular—with the public, with the industry, and with the president that appointed him.

His strategy caused short-term pain but ultimately contributed to prosperity. What does it say about him as a person that he was able to see it through?

It showed tremendous courage. Looking back from 40 years later, it is hard to appreciate how much pressure he was under to change course. Very few public servants could have stood up to this.

You got to know him in the last stage of his career, when he helped shape the response to the global financial crisis. What was the impact of his presence and his ideas?

In the Obama administration, I was a staffer assigned to the President’s Economic Recovery Advisory Board, where Volcker was the chair. He was already over 80 years old, but his energy in advocating for his ideas was extraordinary. In the end, he almost single-handedly convinced the administration and Congress of the necessity of what became the “Volcker Rule” in major legislation passed in 2010.