Accounting

The Price of Trust: How Conflicts of Interest Threaten the Marketplace of Ideas

A new study co-authored by Yale SOM’s John Barrios investigates how conflicts of interest erode trust in the very institutions meant to produce independent knowledge.

In the Wake of the Pandemic, Flexible Work Arrangements Made Workers Less Likely to Start Their Own Businesses

Flexibility has long been a selling point for entrepreneurship. But COVID-19 helped make flexible arrangements more of a norm. A new study co-authored by Yale SOM’s John Barrios shows how this shift in workplace norms changed who starts businesses.

Companies That Receive State Subsidies Are More Likely to Break Workplace Laws

In a new study, Yale SOM’s Aneesh Raghunandan finds that state officials are then less likely to penalize companies that receive subsidies for corporate misconduct—and their leniency seems to encourage firms to ignore regulations.

A Partisan Mismatch with State Government Means Higher Borrowing Costs for Cities

Are red cities marooned in blue states—and blue cities in red states—at a financial disadvantage because of partisan politics? A new study co-authored by Yale SOM’s Anya Nakhmurina finds that cities whose leaders are from the opposite political party as their state governors are penalized in the bond market.

Firms Aren’t Living Up to Their Diversity Claims

A new paper co-authored by Professor Edward Watts finds that for many companies, actual diversity efforts bear little resemblance to the claims made in public disclosures. What’s more, funds from socially conscious investors flow more to firms that engage in this “diversity washing.”

Customer Data Can Reveal Revenue Fraud at Supplier Firms

Yale SOM’s Frank Zhang and his co-authors used publicly available information from suppliers and customers to zero in on the firms that were more likely to be cooking the books.

Did Crypto Cause the FTX Collapse?

Yale SOM’s Rick Antle, an accounting scholar who worked on the Bernie Madoff restitution, says that FTX was a toxic combination of a new asset and a failure of corporate controls.

Quickly Disclosing Bad News Could Help Companies Benefit from Market Signals

Consistently releasing negative forecasts promptly could change trader incentives and ultimately help a company gather more strategic information from the market, according to a new study co-authored by Yale SOM’s Zeqiong Huang.

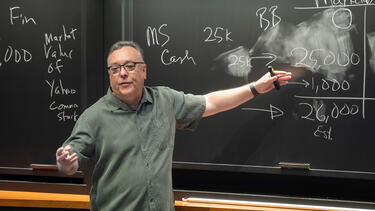

What Is Accounting For?

Prof. Rick Antle explains how accounting serves as the infrastructure for the smooth functioning of society.

Contrary to Conventional Wisdom, Margins Don’t Rise as a Company Grows

Nearly every business plan contains the assumption that as the company grows, its average costs will fall and profit margins will rise. But that isn’t borne out by the numbers.

Keeping a Close Eye on Local Governments’ Finances Can Improve How they Govern

Yale SOM’s Anya Nakhmurina found that fiscal monitoring policies, which require a state office to review local governments’ finances, boosted municipalities’ financial health and reduced corruption convictions of local officials.