Financial Crises

Should the Federal Reserve Reveal More about Its Stress Test Models?

Greg Feldberg, director of research at the Yale Program on Financial Stability, argues that the Fed already discloses more than any other authority in the world about its stress test models and warns that revealing more could repeat mistakes made in the run-up to the Global Financial Crisis of 2008-09.

SEC Chair Gary Gensler on the Future of Systemic Risk in Financial Markets

The SEC chair talked with Yale SOM’s Andrew Metrick about lessons in resilience following the Global Financial Crisis and a fast-approaching future where AI and quantum computing will deliver transformative, potentially destabilizing, impacts on the financial system.

What Did the Last Four Years Teach Us about Managing Inflation?

William English, a professor in the practice of finance and a former economist at the Federal Reserve, discusses lessons learned from central banks’ responses to four-plus years of extraordinary economic disruption.

Is Commercial Real Estate in for a Downturn…or a Crisis?

Commercial real estate downturns don’t typically create systemic threats. Yale SOM’s Andrew Metrick offers a nightmare scenario showing why this time might be different.

Could Better Rules Have Saved Silicon Valley Bank?

Was the closure of Silicon Valley Bank in March a failure of regulation? Greg Feldberg, director of research at the Yale Program on Financial Stability, recently investigated what could have happened if tighter regulations had applied to SVB. He found that better rules could have made a difference.

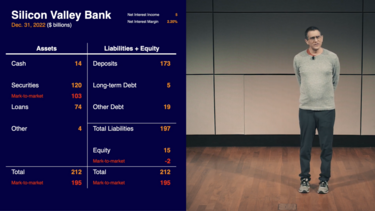

Virtual Lecture: Silicon Valley Bank and the Anatomy of a Bank Run

In this extended video, Prof. Andrew Metrick, director of the Yale Program on Financial Stability, explains why Silicon Valley Bank failed earlier this year, and what the collapse tells us about banking, bailouts, and the nature of financial crises.

The Fed’s Many-Headed Dilemma

According to Prof. William B. English, when Silicon Valley Bank collapsed and sent ripples through the financial system, the Federal Reserve’s challenge of pursuing maximum employment and low inflation “got even harder.”

What’s Next for the Startups That Banked with SVB?

Federal intervention restored access to startups’ funds, but Yale SOM’s Song Ma says there are important lessons in the episode for founders, starting with diversifying their financial relationships.

The Fed Pushed Silicon Valley Bank Off the Cliff

Yale SOM’s Jeffrey Sonnenfeld and Steven Tian and Jeremy Siegel of the Wharton School write that the Federal Reserve’s impatience in taming inflation could tip the economy into crisis.

Is the Collapse of SVB the Start of a Banking Panic?

Silicon Valley Bank, a financial hub for tech startups, failed and was seized by regulators this week. Prof. Andrew Metrick, who has studied past financial crises, explains how SVB’s balance sheet got squeezed and what's next for the banking sector.

Stablecoins Survived ‘Crypto Winter,’ But That Doesn’t Make Them Safe

Cryptocurrencies such as Tether, which is pegged to the dollar, have held on as others crashed. But according to new research by Yale SOM’s Gary Gorton, these “stablecoins” still pose major risks to the global financial system.