Behavioral

Can Holiday Shopping Boycotts Make a Difference?

We asked Yale SOM’s Zoe Chance, an expert on consumer behavior and persuasion, what makes boycotts effective and how companies should respond.

Does Having a Choice Provide an Illusion of Control?

A study co-authored by Yale SOM’s Joowon Klusowski and Deborah Small finds giving people a choice doesn’t makes them think they are more likely to achieve a positive outcome and provides an explanation of why the opposite can appear to be to be true.

Lower-Income Employees Are More Likely to Remain at 401(k) Defaults, Even If It Costs Them Money

Automatically enrolling employees in retirement plans is a powerful tool for increasing savings. But Yale SOM’s James Choi and his coauthors find that once enrolled, people with lower incomes are more likely to remain at default contribution rates, even if they aren’t optimal.

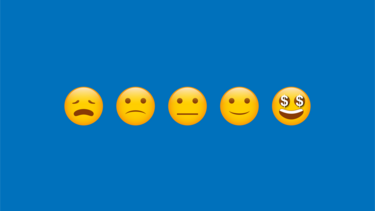

As Incomes Rise, Variability in Happiness Shrinks

New research from Yale SOM’s Gal Zauberman and former postdoc Bouke Klein Teeselink finds there’s both lower average happiness and greater happiness inequality among those with lower incomes.

Can You Make a Donation Today—and Tell All Your Friends?

Sharing information about our charitable donations can multiply their impact. Prof. Deborah Small tested whether reframing why a donor should disclose a gift can help encourage them to spread the good news.

What Does It Mean to Be Generous?

Deborah Small, Adrian C. Israel Professor of Marketing, explores how we make choices that affect our own and others’ welfare and what leaders need to understand about behavioral marketing to expand social impact.

The Dark Side of an Idealized Picture of Nursing

A new ethnographic study from Yale SOM’s Julia DiBenigno illustrates how a focus by workers on a fantasy version of their job can get in the way of organizational goals.

Personal Finance: Popular Authors vs. Economists

Before teaching a personal finance course, Prof. James Choi dipped into some popular books on the topic. He found that much of what personal finance gurus suggest is at odds with economic research—but that they also have insights into human nature that are sometimes missing from economic analyses.

Sermons with Stories of Debt Can Help Churchgoers Stay Frugal

A recent study co-authored by Yale SOM’s Thomas Steffen and Brett Campbell found that when religious leaders gave sermons warning against excessive debt, areas with high church membership tended to have lower indebtedness.

How Social Media Rewards Misinformation

A majority of false stories are spread by a small number of frequent users, suggests a new study co-authored by Yale SOM’s Gizem Ceylan. But they can be taught to change their ways.

Taking a Disciplined Look at Irrational Investors

Prof. Nicholas Barberis applies a scientific eye to the irrational ways we form beliefs and how those beliefs collectively drive financial markets.