Management in Practice

Five Lessons from the 2015 Customer Insights Conference

The rise of the millennial generation and the explosion of mobile technology have permanently changed the landscape for marketers.

What’s the Price of Love?

Choosing a mate is a calculation that the benefits of further search are outweighed by the costs, says Paul Oyer ’89.

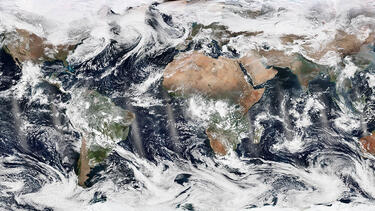

Is Globalization Getting More Complex?

The forces that global companies have to deal with—from social networking to social unrest—have developed rapidly over the last decade. Virgin Group chair Peter Norris describes the trajectory of globalization today and how his company is structured to ride through the turbulence.

Can We Have Economically Secure Retirements?

The end of defined-benefit pensions and a volatile stock market have made many Americans skeptical that they can retire comfortably. Is a new model emerging for how we plan for retirement? A panel of experts and practitioners talks about policies to help us bolster our retirement savings.

How Will E-Commerce Transform the Shipping Industry?

The past four decades of globalization have been a “golden era of global trade,” according to Rajesh Subramaniam, head of marketing and communications at FedEx, and have seen enormous growth for shipping companies. But the growth of online commerce poses new and complex questions for the industry.

Can Cross-Sectoral Collaboration Reverse the Trend toward Income Inequality?

Income and wealth inequality in the U.S. has become a topic of widespread concern and discussion. A recent panel of Yale SOM alumnae posited that action from the federal government is unlikely. But the panelists found reason for hope in examples of the public, private, and nonprofit sectors collaborating to address the nation’s wealth gap.

Where Will Healthcare Innovation Come From?

Healthcare is an industry as much as a science. Innovations that enable the system to deliver better quality at a lower cost are as likely to come from IT, business processes, and design as from new medicines. Moving medicine fully into the digital world could be the linchpin of a more integrated, coordinated approach, if the technology can mesh neatly with the needs of patients, providers, and payers; existing business models; and the complexity of medicine itself.

Rethinking Marketing and Customers: Lessons from Behavioral Economics

Four experts gave a wide-ranging overview of how insights from behavioral economics are being applied in governments, businesses, and other organizations.

What Is Creativity?

Where do the new ideas come from—the ones that change industries and societies? In a lecture at Yale SOM, Prof. Richard Foster explains what creativity is—and isn’t—and describes the kinds of traits, knowledge, and ways of thinking that lead to the moment of creative insight.

How Big Can Organic Grow?

Organic food is booming. Even after a dip during the financial crisis, organics have continued to grow at an impressive clip worldwide. But organic food remains a small fraction of total food consumption. Will organics will ever be able to break into the mainstream? Yale Insights talks with Denis Ring ’84, founder of organic chocolate company Ocho Candy and creator of Whole Foods’ 365 organic store brand.