Finance

The Corporation Is Centuries Older than We Thought

The genesis of the joint-stock company is usually traced to the founding of the English East India Company and the Dutch East India Company around 1600. New research co-authored by Prof. William Goetzmann says this origin story may be off by centuries.

The Business of ‘Anti-Woke’ Is Falling Flat

Yale SOM’s Jeffrey Sonnenfeld and Steven Tian write that the exchange-traded funds that boycott companies taking action on social issues are underperforming the market and struggling to find investors.

How Property Tax Foreclosure Accelerates Gentrification and Magnifies the Racial Wealth Gap

Non-white homeowners are at disproportionate risk of losing their homes over unpaid property taxes, shows new research from Yale SOM’s Cameron LaPoint.

Green Investing Could Push Polluters to Emit More Greenhouse Gases

One common approach to sustainable investing is to provide capital for companies with low carbon emissions and withhold it for high-emissions firms. Research co-authored by Yale SOM’s Kelly Shue shows this approach can backfire.

Why Connecticut’s Investments Are Underperforming

Yale SOM’s Jeffrey Sonnenfeld and Steven Tian and their team found that Connecticut’s return on its pension fund investments is among the worst in the nation. Their analysis of all 50 states offers some avenues for improvement.

Personal Finance: Popular Authors vs. Economists

Before teaching a personal finance course, Prof. James Choi dipped into some popular books on the topic. He found that much of what personal finance gurus suggest is at odds with economic research—but that they also have insights into human nature that are sometimes missing from economic analyses.

The Fed’s Many-Headed Dilemma

According to Prof. William B. English, when Silicon Valley Bank collapsed and sent ripples through the financial system, the Federal Reserve’s challenge of pursuing maximum employment and low inflation “got even harder.”

Is the Collapse of SVB the Start of a Banking Panic?

Silicon Valley Bank, a financial hub for tech startups, failed and was seized by regulators this week. Prof. Andrew Metrick, who has studied past financial crises, explains how SVB’s balance sheet got squeezed and what's next for the banking sector.

Business Prognosticators Keep Getting It Wrong

Yale SOM’s Jeffrey Sonnenfeld explains the mistakes that analysts and forecasters make while trying to predict the future.

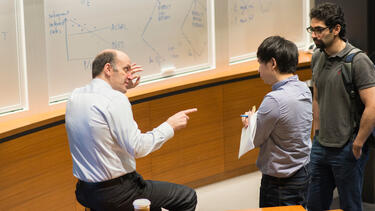

Taking a Disciplined Look at Irrational Investors

Prof. Nicholas Barberis applies a scientific eye to the irrational ways we form beliefs and how those beliefs collectively drive financial markets.

Smarter Ways to Look Ahead: Research-Based Suggestions for a Better 2023

We asked faculty from the Yale School of Management to put a scholarly lens on improving our personal and professional lives in the coming year.