All Insights Articles

For CEOs, Integrity Is the Best Policy

A new study co-authored by Yale SOM’s Thomas Steffen analyzed tens of thousands of shareholder letters to reveal whether executives’ actions typically live up to their promises. It found that firms whose CEOs scored well on this measure of integrity tended to perform better, while facing lower audit fees.

Curtis Chin ’90 on Navigating Right and Wrong across Cultures

Curtis Chin ’90, Asia Fellow at the Milken Institute, on finding solutions to cross-cultural ethical dilemmas.

Kidney Exchange Registries Should Collaborate to Save More Lives

Yale SOM’s Vahideh Manshadi and her co-authors examined the methodology of kidney exchange registries, and found that registries can find more matches if they collaborate to build a unified database.

Don’t Be Surprised by Uber’s Low-Priced IPO—It’s a Sign of Challenges to Come

According to Yale SOM’s Matthew Spiegel and Heather Tookes, an IPO is often followed by disappointing returns, not just for the newly public company but its entire industry.

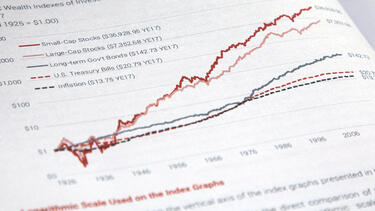

A Life in Finance: A Conversation with Prof. Roger Ibbotson

Professor Roger Ibbotson, an influential scholar and practitioner of finance for decades, sat down for a conversation with Professor William Goetzmann about his groundbreaking work on the historical returns of the stock market, his experiences as a teacher, and his current research.

James Robertson ’99 on the Fallout from Doing the Right Thing

James Robertson ’99, former CEO of the India HIV/AIDS Alliance, on facing the consequences of a tough ethical call—and the unexpected upside that can result.

Three Questions: Prof. Cristina Rodríguez on the Immigration Crises

Is there a crisis at the U.S. southern border? We asked Cristina Rodríguez of Yale Law School, whose research interests include immigration law and policy, to shed light on the reality behind the divisive politics.

Forgiving Debts May Boost Employment During Recessions

In an analysis of the Great Recession, Yale SOM's Paul Goldsmith-Pinkham and his co-authors found that debt relief increased employment by up to 2% nationwide.

Think Biden and Trump Are Too Old for the White House? Take a Look Around.

Yale SOM’s Jeffrey Sonnenfeld points to research on the strengths of older people and the accomplishments of politicians and business leaders in their 60s, 70s, and 80s.

Three Questions: Prof. Soheil Ghili on Why Amazon Shoppers Aren’t Embracing Whole Foods

To convert its Prime customers into Whole Foods shoppers, Amazon is cutting prices at the stores and offering discounts to Prime members. Yale SOM’s Soheil Ghili explains the company’s strategy.