Research

Is Women’s Work Evaluated Fairly?

Does gender bias prevent women from being treated fairly in job interviews, performance assessments, and other evaluations? Data from an online stock recommendation platform suggests that women’s ideas simply get less attention than their male colleagues’.

Do Companies Buy Competitors in Order to Shut Them Down?

A study co-authored by Yale SOM researchers Florian Ederer and Song Ma suggests that “killer acquisitions” by pharmaceutical companies are potentially limiting the number of new treatments available.

Could Better Predictions Improve End-of-Life Care?

A statistical tool that predicts when patients with advanced cancer are likely to die could help promote patient welfare by transferring more people from aggressive interventions to hospice care.

Insights Animation: Why Integrated Cities Produce More Startups

Venture capital investments in more racially integrated cities are more effective, producing more innovation and economic growth. Yale SOM’s Olav Sorenson explains why that might be.

Why Is My Boss Incompetent?

The Peter Principle says that hierarchical organizations suffer because effective workers are promoted until they reach their “level of incompetence.” Yale SOM's Kelly Shue and her collaborators set out to test the oft-cited theory.

Is Your Sales Team Courting the Wrong Customers?

A group of Yale SOM researchers examined what kinds of sales incentives lead to profits, and whether longstanding relationships between salespeople and customers are always a good thing.

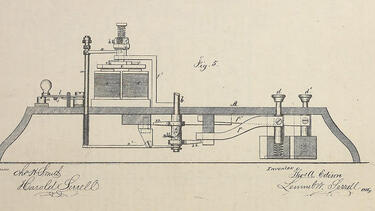

Why Do Women Inventors Win Fewer Patents?

Women inventors are less likely to have their patent applications approved than men. But that disparity dips if an examiner can’t guess an inventor’s gender from her name.

Does Automatic Enrollment into Retirement Plans Hurt Household Finances?

When companies automatically enroll employees in retirement plans, the employees save more money for their later years. But the extra savings may exact a pre-retirement toll on their finances.

Do We Know When We’re Headed for a Crash?

A new paper looking at how investors assess the risk of a stock market crash in the next six months argues that negative media coverage of markets can play a role in investment decisions.

How Do Investors Respond to Uncertainty?

Conventional wisdom says that uncertainty is bad for markets. But Yale SOM’s Stefano Giglio and his co-authors found that investors are willing to pay a premium to protect themselves only against actual market volatility, not mere uncertainty.