All Insights Articles

Five Lessons from the 2015 Customer Insights Conference

The rise of the millennial generation and the explosion of mobile technology have permanently changed the landscape for marketers.

Is the Canadian Dollar a Petrocurrency?

Werner Antweiler of UBC’s Sauder School of Business says that Canada’s dollar is acting like a classic petrocurrency.

The Myth of Nepal’s Missing Men

Professor Mushfiq Mobarak and co-author Alix Zwane argue that discouraging labor migration is not the right way to help Nepal recover.

Can Guilt Make You Happy?

Two new studies from Yale SOM’s Ravi Dhar suggest that a touch of guilt can be a powerful tool for marketers.

Is Making All Banks Follow the Same Rules a Bad Idea?

Standardization. Harmonization. Coordination. They all sound like good ideas. But in a lecture at Yale SOM, Roberta Romano, the Sterling Professor of Law at Yale Law School, argued that the convergence of banking regulations brought about by the Basel Accords may have had the unintended effect of fueling the financial crisis.

What’s the Price of Love?

Choosing a mate is a calculation that the benefits of further search are outweighed by the costs, says Paul Oyer ’89.

Inspiring Economic Growth

Robert Shiller proposes government spending that inspires a vision of a better future.

Despite Risks, Garment Factory Jobs Have Long-Term Benefits for Bangladeshi Women

A new study finds that garment factory work reshapes the lives of women in Bangladesh in positive ways.

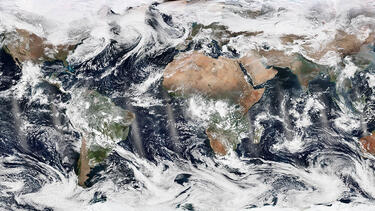

Is Globalization Getting More Complex?

The forces that global companies have to deal with—from social networking to social unrest—have developed rapidly over the last decade. Virgin Group chair Peter Norris describes the trajectory of globalization today and how his company is structured to ride through the turbulence.

More Public Toilets May Reduce Sexual Assault in South Africa

A new study by researchers at the Yale School of Management and the Yale School of Public Health.