Finance

The Corporation Is Centuries Older than We Thought

The genesis of the joint-stock company is usually traced to the founding of the English East India Company and the Dutch East India Company around 1600. New research co-authored by Prof. William Goetzmann says this origin story may be off by centuries.

How Does Private Equity Create Value?

With bargains hard to find, says Adam Blumenthal ’89, private equity must return to its roots, as a tool for value creation for a range of stakeholders.

What are the Returns from Women Investing in Women?

Patricia Lizarraga of Hypatia Capital Group explains how the firm succeeds by investing in women.

How Do You Spot a Financial Bubble?

Are we in a financial bubble? Vikram Mansharamani YC ’96 offers a framework for spotting a bubble before it bursts.

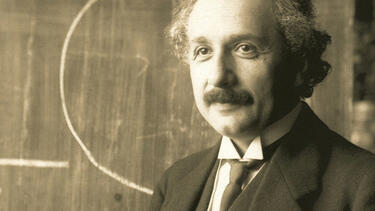

In Long Run, There’s No Such Thing as an Einstein Investor

In a New York Times commentary, Yale SOM's Robert Shiller says that investors can’t consistently beat the market by copying the strategy of a lone genius.

How Tales of ‘Flippers’ Led to a Housing Bubble

Yale SOM's Robert Shiller writes that widely repeated narratives of getting rich in real estate drove a housing bubble a decade ago—and could do so again.

Why Aren’t Women Saving Enough for Retirement?

TIAA’s chief income strategist says while the retirement system appears to be gender neutral, it is putting women at a disadvantage.

Is Our Financial System Still at Risk?

Yale’s Andrew Metrick discusses what we learned from the last financial crisis and areas of concern for the future.

Should You Invest in Uncertain Environments?

A focus on fundamentals can reveal opportunities in the Middle East, despite conflict, political upheaval, and economic uncertainty.

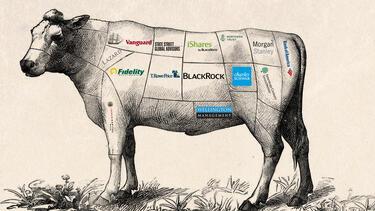

What Happens When the Same Investors Own Everything?

Diversification means that in many industries, companies are owned by an overlapping set of investors, reducing their incentive to compete.

Did Finance Make Civilization Possible?

Prof. William Goetzmann traces the millennia-long relationship between finance and the growth of civilization.