Finance

Can AI Replace Human Debt Collectors?

New research co-authored by Yale SOM Professor James Choi finds that people are less likely to follow through on a commitment to repay a debt if it’s made to an AI agent. The finding hints at one area where humans may always retain an advantage over bots.

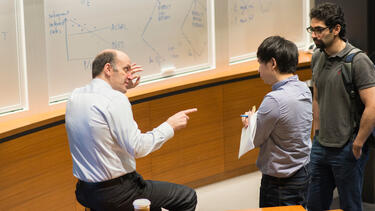

Personal Finance: Popular Authors vs. Economists

Before teaching a personal finance course, Prof. James Choi dipped into some popular books on the topic. He found that much of what personal finance gurus suggest is at odds with economic research—but that they also have insights into human nature that are sometimes missing from economic analyses.

The Fed’s Many-Headed Dilemma

According to Prof. William B. English, when Silicon Valley Bank collapsed and sent ripples through the financial system, the Federal Reserve’s challenge of pursuing maximum employment and low inflation “got even harder.”

Is the Collapse of SVB the Start of a Banking Panic?

Silicon Valley Bank, a financial hub for tech startups, failed and was seized by regulators this week. Prof. Andrew Metrick, who has studied past financial crises, explains how SVB’s balance sheet got squeezed and what's next for the banking sector.

Business Prognosticators Keep Getting It Wrong

Yale SOM’s Jeffrey Sonnenfeld explains the mistakes that analysts and forecasters make while trying to predict the future.

Taking a Disciplined Look at Irrational Investors

Prof. Nicholas Barberis applies a scientific eye to the irrational ways we form beliefs and how those beliefs collectively drive financial markets.

Smarter Ways to Look Ahead: Research-Based Suggestions for a Better 2023

We asked faculty from the Yale School of Management to put a scholarly lens on improving our personal and professional lives in the coming year.

Did Crypto Cause the FTX Collapse?

Yale SOM’s Rick Antle, an accounting scholar who worked on the Bernie Madoff restitution, says that FTX was a toxic combination of a new asset and a failure of corporate controls.

Can AI Make Economic Predictions by Reading the Newspaper?

In a new study, a team led by Yale SOM researchers devised a way to distill the text of the Wall Street Journal into numerical indicators, which could help policymakers predict how the business cycle will unfold over the coming months and years.

Will the Fed Keep Raising Rates?

We asked Prof. William English, a former Fed official, to interpret the announcements at the Federal Open Market Committee’s monthly meeting last week.

A Yale Economist Read 50 Personal Finance Books. He’s Got Some Notes.

Personal finance gurus frequently depart from conventional economic wisdom, Yale SOM’s James Choi discovered, but their advice isn’t all bad.