James Choi

Can AI Replace Human Debt Collectors?

New research co-authored by Yale SOM Professor James Choi finds that people are less likely to follow through on a commitment to repay a debt if it’s made to an AI agent. The finding hints at one area where humans may always retain an advantage over bots.

Do Nudges Help Americans Save for Retirement? Not as Much as We Thought.

Two decades ago, Prof. James Choi’s research suggested that automatic enrollment and escalation and could have a sizeable impact on savings. Now he and his co-authors have looked at these programs again and found that under real-world conditions, the effect on savings is much smaller than expected.

Lower-Income Employees Are More Likely to Remain at 401(k) Defaults, Even If It Costs Them Money

Automatically enrolling employees in retirement plans is a powerful tool for increasing savings. But Yale SOM’s James Choi and his coauthors find that once enrolled, people with lower incomes are more likely to remain at default contribution rates, even if they aren’t optimal.

Personal Finance: Popular Authors vs. Economists

Before teaching a personal finance course, Prof. James Choi dipped into some popular books on the topic. He found that much of what personal finance gurus suggest is at odds with economic research—but that they also have insights into human nature that are sometimes missing from economic analyses.

A Yale Economist Read 50 Personal Finance Books. He’s Got Some Notes.

Personal finance gurus frequently depart from conventional economic wisdom, Yale SOM’s James Choi discovered, but their advice isn’t all bad.

How Nudges Could Boost Vaccination Rates

A study co-authored by Yale SOM’s James Choi tested a variety of text messages to prompt people to get flu vaccines, offering one potential tool to encourage those who aren’t rushing to get a COVID shot.

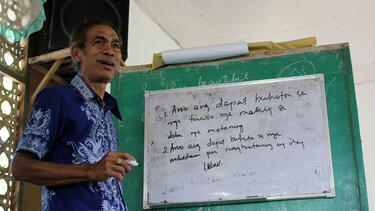

Can Religious Teachings Help Lift People Out of Poverty?

A study in the Philippines, co-authored by Yale SOM’s James Choi, suggests that learning Protestant Christian values and theology can boost poor families’ income.

Does A Mutual Fund’s Past Performance Predict Its Future?

A classic 1997 paper on mutual fund performance doesn’t describe present-day markets, Yale SOM's James Choi found.

What the Plunge in the Stock Market Means for Individual Investors

We asked Yale SOM’s James Choi, who has examined the implications of academic research for personal finance, what studies say about how to respond to a market crash.

When Prompting People to Make a Choice, the Consequence of Not Choosing Matters

In a new study, Yale SOM’s James Choi and his colleagues found that the implicit default—what happens if people don't make a choice—affects whether they make a choice at all.