Gary B. Gorton

Stablecoins Survived ‘Crypto Winter,’ But That Doesn’t Make Them Safe

Cryptocurrencies such as Tether, which is pegged to the dollar, have held on as others crashed. But according to new research by Yale SOM’s Gary Gorton, these “stablecoins” still pose major risks to the global financial system.

How ‘Stablecoins’ Could Unleash Chaos

Dollar-pegged cryptocurrencies are rapidly proliferating. But without regulation, these so-called stablecoins pose serious risks to the U.S. financial system, argue Yale SOM’s Gary B. Gorton and his co-author.

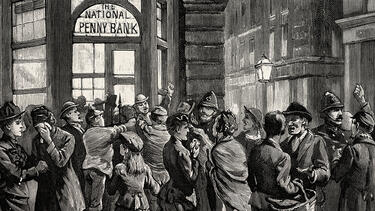

To Prevent Financial Crises, Regulate Short-Term Debt

Yale SOM’s Gary Gorton argues that financial crises happen because short-term lending, while essential to the economy, is also vulnerable to panic when parties lose confidence in each other. In a new paper, Gorton proposes a method of regulating short-term debt and preventing future crises.

Competition Can Make Corporate Cultures More Socially Progressive

A study by Yale SOM’s Alexander Zentefis and Gary Gorton suggests a progressive competitor can push a company to change under the right circumstances.

Can We Prevent Future Crises?

Was the 2008 financial crisis a one-time event or the first example of a new pattern? Professor Gary Gorton argues that the history of banking shows that there’s a real risk of future upheaval in financial markets.

Where does securitization stand?

Yale SOM finance professors Frank Fabozzi, Gary Gorton, and Will Goetzmann discuss what caused the financial crisis, what we have learned since then, likely impacts of the financial reform legislation, and proposals to address unresolved issues in the housing and securitization markets.

Did innovation cause the credit crisis?

By 2006, the subprime market had grown to 20% of the total U.S. mortgage market, and 75% of these loans were securitized and sold off to investors around the world, facilitating an influx of capital. With credit easily available, more people than ever before were able to buy homes — but then the market seized up.