Florian Ederer

A Wave of Acquisitions May Have Shielded Big Tech from Competition

According to a new study co-authored by Florian Ederer, the fraction of startups that are acquired has skyrocketed, eliminating many potential competitors of big tech firms.

Did Ticketmaster’s Market Dominance Fuel the Chaos for Swifties?

Taylor Swift fans scrambling for concert tickets faced endless queues and crashes on the Ticketmaster website. Yale SOM economist Florian Ederer explains the antitrust issues at play and the tradeoffs inherent in satisfying overwhelming demand.

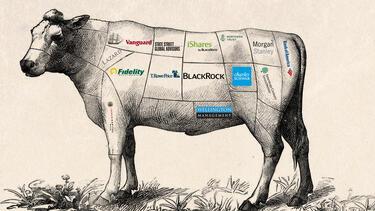

The Rise of the Mutual Fund Is Reducing Corporate Competition and Hurting Consumers

Mutual funds have become large shareholders in most public U.S. firms. The resulting overlaps in ownership are boosting corporate profits but harming consumers, according to a new study co-authored by Florian Ederer of Yale SOM.

Does Big Tech Gobble Up Competitors?

An executive order from President Joe Biden last month and a congressional report in October accused large technology firms of engaging in “killer acquisitions,” citing research by Yale SOM’s Florian Ederer.

When Corporate Acquisitions Affect Healthcare

Companies often purchase competitors, not to acquire their ideas and products, but to shut them down. A recent report raised questions about whether such an acquisition may be partially responsible for a shortage of ventilators in the United States.

New Study Shows that Trust Can Last

A new study co-authored by Yale SOM’s Florian Ederer explores how the trust we place in one another is affected by our ability to communicate and by the passage of time.

Three Questions: Prof. Florian Ederer on ‘Killer Acquisitions’

A recent lawsuit alleged that a billionaire investor bought the rights to a new drug just to eliminate a potential competitor. We asked Yale SOM's Florian Ederer to explain why a "catch-and-kill" merger can be damaging and what to do about the phenomenon.

How Can You Make Incentives More Effective? Make Them Opaque.

A study from Yale SOM’s Florian Ederer suggests that when individuals or organizations don’t fully understand how they’re being ranked, they’re likely to work harder for higher ratings.

Do Companies Buy Competitors in Order to Shut Them Down?

A study co-authored by Yale SOM researchers Florian Ederer and Song Ma suggests that “killer acquisitions” by pharmaceutical companies are potentially limiting the number of new treatments available.

What Happens When the Same Investors Own Everything?

Diversification means that in many industries, companies are owned by an overlapping set of investors, reducing their incentive to compete.