Andrew Metrick

Is Commercial Real Estate in for a Downturn…or a Crisis?

Commercial real estate downturns don’t typically create systemic threats. Yale SOM’s Andrew Metrick offers a nightmare scenario showing why this time might be different.

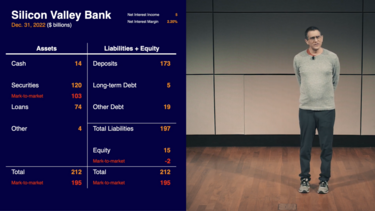

Virtual Lecture: Silicon Valley Bank and the Anatomy of a Bank Run

In this extended video, Prof. Andrew Metrick, director of the Yale Program on Financial Stability, explains why Silicon Valley Bank failed earlier this year, and what the collapse tells us about banking, bailouts, and the nature of financial crises.

Is the Collapse of SVB the Start of a Banking Panic?

Silicon Valley Bank, a financial hub for tech startups, failed and was seized by regulators this week. Prof. Andrew Metrick, who has studied past financial crises, explains how SVB’s balance sheet got squeezed and what's next for the banking sector.

Can We Reduce Risk from the Shadow Banking System?

According to Prof. Andrew Metrick, new rules on banks have helped push risk to non-bank firms that aren’t subject to the same limitations. In a recent paper, Metrick and former Fed governor Daniel Tarullo propose ways to bring regulation of banks and this “shadow banking system” into better alignment.

Awaiting the Will to Ensure Financial Market Stability

In a conversation with Yale SOM’s Andrew Metrick, Paul Tucker, chair of the Systemic Risk Council and former deputy governor for financial stability at the Bank of England, says that financial markets are still facing serious stability risks.

Is it Time to Shut Down the Fed’s COVID Stimulus Programs?

Prof. Andrew Metrick, director of the Yale Program on Financial Stability, says that the four emergency lending programs recently shut down by Treasury Secretary Steven Mnuchin are an insurance policy that may be badly needed in 2021.

Can Government Contain the Economic Crisis?

Prof. Andrew Metrick, director of the Yale Program on Financial Stability, says that fighting a crisis is different from economic policymaking in normal times; governments need to be exceptionally generous and not get bogged down in stringent processes that keep money from getting to those in need.

Three Questions: Prof. Andrew Metrick on Paul Volcker’s Legacy

Paul Volcker, former chairman of the Federal Reserve, died on December 8 at age 92. Prof. Andrew Metrick reflects on Volcker’s contributions to the Fed and economic policy.

Three Questions: Prof. Andrew Metrick on What Makes a Good Pick for the Fed

President Trump recently announced his intention to appoint two well-known conservative figures—Stephen Moore and Herman Cain—to the Federal Reserve Board of Governors. We asked Prof. Andrew Metrick about the qualities of an effective Fed governor.

Lessons for the Crisis Fighters

Yale SOM’s Andrew Metrick and the Yale Program on Financial Stability are studying the global financial crisis of 2007-09, working to create the knowledge and tools to prepare the next generation of policymakers who find themselves in the eye of a monetary maelstrom.