The Rise of the Mutual Fund Is Reducing Corporate Competition and Hurting Consumers

As more and more people have invested in the stock market through funds from companies such as BlackRock and Vanguard, those intermediary firms have become large shareholders in most public U.S. firms. The resulting overlaps in ownership are boosting corporate profits but harming consumers, according to a new study co-authored by Florian Ederer of Yale SOM.

Over the last few decades, large investment firms such as BlackRock, Vanguard, and Fidelity have grown dramatically. These companies act as financial intermediaries, offering index funds that allow people to easily invest in a diverse portfolio of stocks. But because the funds typically include multiple companies from each industry, this seemingly positive trend also leads to a phenomenon called common ownership: The intermediary firms are now large shareholders in many companies that are supposed to compete with each other.

The rise of common ownership has generated concerns that firms’ incentive to compete has weakened. Companies might be less willing to expand their capacity or engage in price wars.

“Usually companies wouldn’t care about the profits of other firms. But because they share the same set of shareholders, they may be more hesitant to compete.”

“Usually they wouldn’t care about the profits of other firms,” says Florian Ederer, an associate professor of economics at Yale SOM. “But because they share the same set of shareholders, they may be more hesitant to compete.”

In a new study, Ederer and a colleague concluded that common ownership can have substantial economy-wide ramifications. Their results suggest that overlaps in ownership have increased “deadweight loss,” a measure of lost efficiency. And while corporate profits have risen, the value that consumers receive has dropped.

“It seems to have tremendous impact,” Ederer says. “And an impact that wasn’t really there 25 years ago.” Common ownership, he says, “is increasingly harming consumers.”

Common shareholders could influence companies in a couple of ways. One possible mechanism is passive: they might refrain from rewarding executives for reaping higher profits at the expense of their rivals, which reduces the pressure to compete aggressively. In fact, another study co-authored by Ederer suggests that, at firms with a high degree of investor overlap with competitors, CEOs tend to receive fewer performance incentives. Or investors could be taking direct action, intervening in a firm’s strategy decisions to discourage competition.

Other researchers have examined the effects of common ownership in specific industries. But Ederer and his collaborator, Bruno Pellegrino at the University of Maryland, wanted to investigate economy-wide consequences.

One such measure was corporate profits. Another was consumer surplus, which is essentially the net value that consumers receive from making a purchase. For instance, if someone buys an apple for $1, but it’s worth $4 to them (in terms of the experience or “utility” they derive from it), the consumer surplus is $3.

Corporate profits combined with consumer surplus add up to a measure called total surplus. If total surplus decreases, that drop is called deadweight loss, meaning that economic efficiency has been lost.

The researchers started by creating an economic model of firms with three scenarios. One scenario is perfect competition, an “economic nirvana” in which every company prices their goods at exactly the cost required to make them, resulting in zero profits but large consumer surplus. The second is oligopoly, in which firms have some market power and could raise prices slightly, but no overlapping investors. This scenario is similar to the real-world situation several decades ago, before the rise of common ownership.

And the third scenario is common ownership, in which firms were entangled in a network of overlapping investors. Instead of maximizing only their own profits, each company maximized the collective profits earned by their firm and competing firms in their investors’ portfolios, weighted by holdings. Consumers in the model purchased goods and also benefited from the companies’ profits, through their investments in those firms.

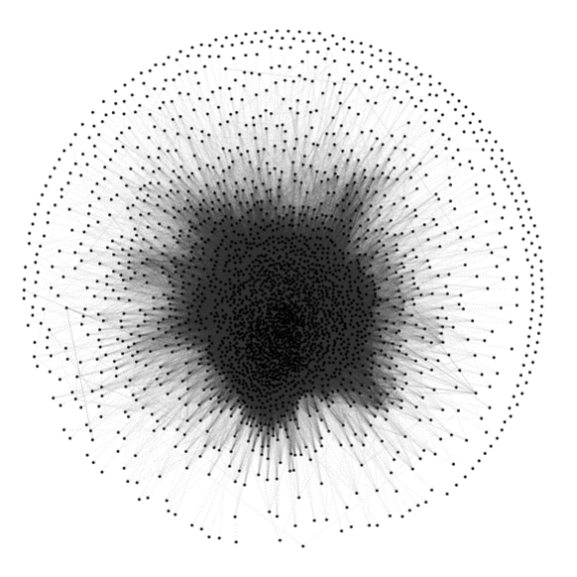

Figure 1: The Network of Common Ownership

To calibrate the model, the researchers obtained data on U.S. public corporations from 1994 to 2018. From SEC filings, they determined the overlap in institutional investor holdings for these firms which allowed them to construct the network of ownership holdings. Firms that have more similar shareholders are shown as more closely situated and linked to each other in the network (figure 1).

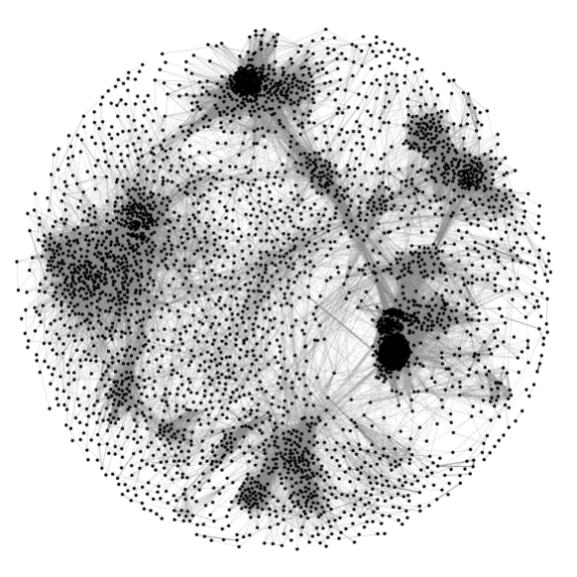

To figure out which companies competed with each other, the team drew from an existing database of product similarity scores, which were based on linguistic analyses of business descriptions. Firms that offer more similar products are closer in the product space network and therefore compete more intensely with each other while more “isolated” firms face less intense competition (figure 2).

Figure 2: The Network of Product Similarity

The researchers then ran the model’s three scenarios to determine economic outcomes in the year 2018. The best outcome for consumers (and also the highest total surplus) occurs under perfect competition. Under oligopoly, total surplus is 11.5% lower, and under common ownership, total surplus drops by another 4%.

Consumers bear the burden of this lost efficiency. Compared to the oligopoly scenario, corporate profits under common ownership rise by $378 billion. But consumer surplus decreases by $799 billion, in spite of the additional earnings that people receive through investments in those companies.

Under common ownership, firms are charging higher prices and making more money, but people are buying fewer goods and getting less value. “The consumers are losing out,” Ederer says. “But the firms profit from it.”

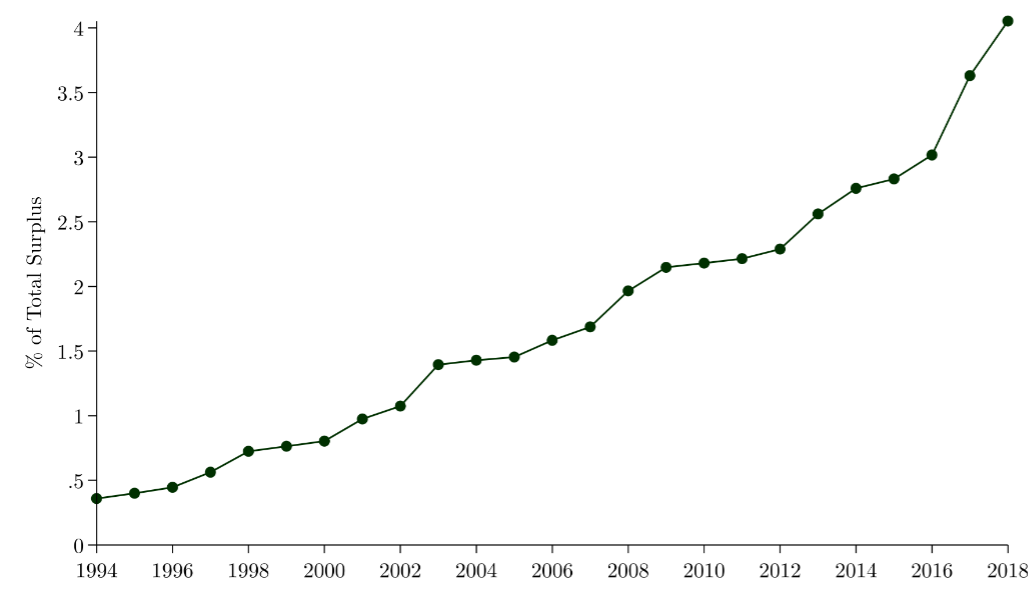

The situation wasn’t so dire a few decades ago. Ederer and Pellegrino estimated that in 1994, the deadweight loss due to common ownership was only 0.3% but steadily rose to 4% of total surplus in 2018.

Figure 3: Deadweight Loss from Common Ownership

“We were right not to worry about common ownership in 1994,” Ederer says. But “we should probably start worrying about it now.”

Ederer cautions that common ownership may confer some benefits that weren’t accounted for in the study. For instance, perhaps easier access to diversified investing justifies the loss in consumer surplus.

But overall, the study suggests that policymakers should pay attention to this worrying trend. “We started off asking the question of ‘Is there a big economy-wide impact of common ownership?’” Ederer says. “The answer is, according to our analysis, absolutely yes.”

And without policy intervention, will common ownership continue to reduce economic efficiency and slow the growth of consumer surplus? For now, he says, “the trend shows no sign of abating.”