Song Ma

What’s Next for the Startups That Banked with SVB?

Federal intervention restored access to startups’ funds, but Yale SOM’s Song Ma says there are important lessons in the episode for founders, starting with diversifying their financial relationships.

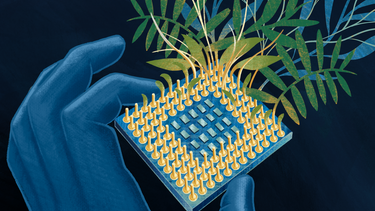

R&D Investment Can Have Multiplier Effects—If It’s Made in the Right Industries

A new study co-authored by Prof. Song Ma finds that allocating research funding to certain scientific fields can have long-term ripple effects across sectors and countries.

Private Equity Investors Helped Stabilize Failed Banks During the Financial Crisis

A new study co-authored by Prof. Song Ma finds that during the financial crisis, private equity firms took on banks in poor health that other buyers didn’t want, and those banks performed relatively well under their new management.

A Passionate Startup Pitch Is Powerful—But Can Be Misleading

According to a new study co-authored by Yale SOM’s Song Ma, those with cheerful and enthusiastic presentations are more likely to get venture capital funding—and less likely to build successful ventures.

When Corporate Acquisitions Affect Healthcare

Companies often purchase competitors, not to acquire their ideas and products, but to shut them down. A recent report raised questions about whether such an acquisition may be partially responsible for a shortage of ventilators in the United States.

Companies Invest in Startups to Repair Weaknesses

A study by Yale SOM’s Song Ma shows that companies tend to invest in startups when they are struggling, in order to gain access to innovation and shore up an area of weakness.

Activist Shareholders May Help Firms in the Long Term

Do activist shareholders choose quick profits over long-term health? Yale SOM’s Song Ma and his collaborators find evidence that their interventions boost innovation.

Do Companies Buy Competitors in Order to Shut Them Down?

A study co-authored by Yale SOM researchers Florian Ederer and Song Ma suggests that “killer acquisitions” by pharmaceutical companies are potentially limiting the number of new treatments available.