Three Questions: Professor Shyam Sunder on Why We Pay Taxes

It’s nearly Tax Day in the United States, which means that the procrastinators among us are scrambling to find receipts and puzzling through tax forms. Is all this misery really the best way to gather the funds to pay for public goods? We talked to Yale SOM’s Shyam Sunder, an expert in accounting who recently carried out an experiment to see if there might be a better way.

Mark Burnett/Alamy Stock Photo

Why do so many people hate taxes?

People hate having to collect and review their transactions, and paper and electronic records as much as 16 months old, and trying to interpret rules so complicated that even expert opinions differ, all under the threat of punishment for innocent errors. If the bottom line calls for writing a check, that is not welcome either. The news reports that some very rich people pay little taxes makes even the public-minded wonder if they are paying their fair share of the cost of public services in society.

With electronic transactions and records for payroll and investments, governments already have almost all the information necessary for accurately estimating the taxes owed by the vast majority of individuals. In many countries around the world (e.g., Denmark and Japan), the tax day is hardly noticed because the governments calculate the taxes due, and make an adjustment if it is different from the amount withheld.

In the U.S., the Internal Revenue Service also has this capability, but has been prevented from offering this service to the taxpayers by Congress under the influence of heavy lobbying by those who make a living selling tax preparation software and services. Some $10 million in targeted contributions from a single tax software firm helps impose billions in hours of work and dollars of cost for the rest of us. The annual cycle of April 15 frustrations is as good an example as any of the Olson-Stigler model of industry lobbying, when the benefits of legislation are concentrated in the hands of a few, and the costs are thinly distributed among many.

How do you think about what the optimal tax rate might be?

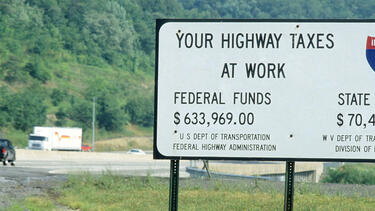

It is unlikely that there is a single optimal tax rate for any society. It would depend on the volume and distribution of public services (such as highways, sanitation, defense, and education) we want, and how these costs are distributed across the people. Governments finance themselves by many kinds of taxes, including income, sales, value-added, excise, customs, real estate, etc., each governed by its own regime. How much of the total revenue is raised from various sources is a matter of tax policy.

Is there any better way to finance public goods than taxes?

Philanthropy has long been an important source of financing public services. But it is less predictable than taxes, both in total collection as well as the distribution of its sources. Motivations for philanthropy vary greatly across individuals, societies, and time. This variability is the likely reason that financing of essential public services tends to rely on taxation.

I recently carried out an experiment with Juergen Huber of the University of Innsbruck and Yale’s Martin Shubik to compare the feasibility and efficacy of financing of public goods by voluntary anonymous contributions versus democratically set tax rates. We found that public goods rapidly declined under voluntary contributions, and the subjects preferred enforceable taxes to finance public goods.

A democratically-determined and well-managed system of taxation is seen to be fair, and allows individuals to anticipate their tax and plan their economic affairs. The cake of legislated taxation, topped by the icing of discretionary philanthropy, is a flexible and sustainable combination to finance public services.