Finance

Beauty, Power, Art, and Finance

Art, money, and power twist together in complex ways, in a dynamic that may be older than humans. In his research, Yale SOM’s William Goetzmann traces the social meaning of art and money and the ways they set pecking orders, create art superstars, and blow up into senseless bubbles.

What We Talk about When We Talk about Stock Market Crashes

Yale SOM’s Robert Shiller examines how the stock market rise of the 1920s, the crash of 1929, and the Great Depression that followed came to be seen as a tale of recklessness and divine punishment.

For a Path to a Decarbonized Economy, Look to the States

Robert Klee, a lecturer at Yale and the former commissioner of the Connecticut Department of Energy and Environmental Protection, says that state-level approaches to the climate crisis provide a roadmap for a 10-year, trillion-dollar effort to put the U.S. on a path to decarbonization.

Why We Need Finance to Fight Climate Change

There won’t be a transition to clean energy without a way to finance what could be the largest infrastructure project ever undertaken. Yale Insights talked with Jeffrey Schub ’13 of the Coalition for Green Capital about what a National Climate Bank could achieve.

For Top Venture Capital Firms, Success Breeds Success

Most investing success is short lived, but venture capital is an exception, with top VCs beating the average year after year. A new study finds that consistent returns owe as much to a firm’s reputation and early luck as the smarts of its employees.

Companies Invest in Startups to Repair Weaknesses

A study by Yale SOM’s Song Ma shows that companies tend to invest in startups when they are struggling, in order to gain access to innovation and shore up an area of weakness.

Three Questions: Prof. Vineet Kumar on Facebook’s Move into Cryptocurrency

On June 18, Facebook announced Libra, a new cryptocurrency intended to make it easy for individuals and companies to exchange payments anywhere in the world. We asked Prof. Vineet Kumar why a company that started by enabling people to share personal news is now building an alternative financial system.

Don’t Be Surprised by Uber’s Low-Priced IPO—It’s a Sign of Challenges to Come

According to Yale SOM’s Matthew Spiegel and Heather Tookes, an IPO is often followed by disappointing returns, not just for the newly public company but its entire industry.

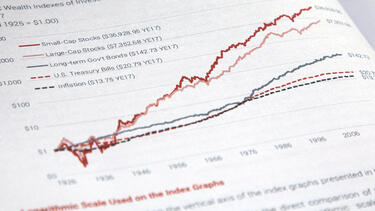

A Life in Finance: A Conversation with Prof. Roger Ibbotson

Professor Roger Ibbotson, an influential scholar and practitioner of finance for decades, sat down for a conversation with Professor William Goetzmann about his groundbreaking work on the historical returns of the stock market, his experiences as a teacher, and his current research.

Forgiving Debts May Boost Employment During Recessions

In an analysis of the Great Recession, Yale SOM's Paul Goldsmith-Pinkham and his co-authors found that debt relief increased employment by up to 2% nationwide.

How Leverage Turns Market Corrections into Crashes

Leverage-induced fire sales contributed to the worst stock market crashes in history. Prof. Kelly Shue studied account-level data from the Chinese market crash in 2015 to illuminate how much leverage matters.