Finance

CEOs Invest Less in Corporate Social Responsibility When Their Own Money Is At Stake

A study co-authored by Yale SOM’s Kelly Shue finds that when CEOs have a larger financial stake in their companies, or when they face stronger shareholder oversight, they cut back spending on corporate social responsibility efforts.

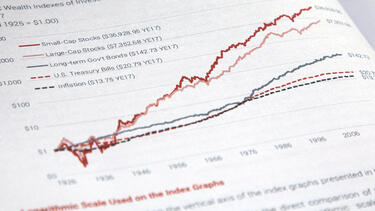

A Life in Finance: A Conversation with Prof. Roger Ibbotson

Professor Roger Ibbotson, an influential scholar and practitioner of finance for decades, sat down for a conversation with Professor William Goetzmann about his groundbreaking work on the historical returns of the stock market, his experiences as a teacher, and his current research.

Forgiving Debts May Boost Employment During Recessions

In an analysis of the Great Recession, Yale SOM's Paul Goldsmith-Pinkham and his co-authors found that debt relief increased employment by up to 2% nationwide.

How Leverage Turns Market Corrections into Crashes

Leverage-induced fire sales contributed to the worst stock market crashes in history. Prof. Kelly Shue studied account-level data from the Chinese market crash in 2015 to illuminate how much leverage matters.

Three Questions: Prof. Andrew Metrick on What Makes a Good Pick for the Fed

President Trump recently announced his intention to appoint two well-known conservative figures—Stephen Moore and Herman Cain—to the Federal Reserve Board of Governors. We asked Prof. Andrew Metrick about the qualities of an effective Fed governor.

Activist Shareholders May Help Firms in the Long Term

Do activist shareholders choose quick profits over long-term health? Yale SOM’s Song Ma and his collaborators find evidence that their interventions boost innovation.

Three Questions: Prof. Paul Goldsmith-Pinkham on Payday Loans and Consumer Protection

The Consumer Financial Protection Bureau will stop requiring payday lenders to confirm borrowers' ability to repay. We asked Yale SOM's Paul Goldsmith-Pinkham what this change might mean to financially strapped Americans.

Will Machine Learning Transform Finance?

Charles Elkan, Goldman Sachs’ global head of machine learning, on the technology can extract value from the natural resource that is defining this century—data.

Can Green Banks Scale Clean Energy?

Richard Kauffman ’83 explains how the New York Green Bank has made possible $1.5 billion in clean energy projects that wouldn’t otherwise have happened.

Three Questions: Prof. Andrew Metrick on Revising the Volcker Rule

U.S. regulators have proposed revising the Volcker rule, which restricts the ability of banks to make risky trades with money from depositors. We asked Yale SOM’s Andrew Metrick about the potential consequences of the change.

Do We Know When We’re Headed for a Crash?

A new paper looking at how investors assess the risk of a stock market crash in the next six months argues that negative media coverage of markets can play a role in investment decisions.