Three Questions: Prof. Roger Ibbotson on Low Volatility

In a period of apparent political and diplomatic upheaval, the U.S. stock market has seen unusually low volatility. We asked Roger Ibbotson, a professor in the practice emeritus of finance who has made a lifelong study of how and why markets move, to help explain this mystery.

Is the current period of low volatility, as measured by VIX, remarkable in your view?

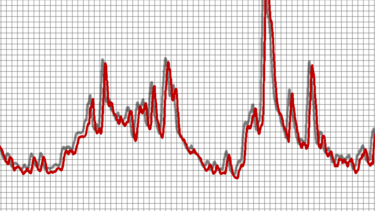

The volatility in 2017 is reaching historical lows, although the VIX (on the S&P 500) was almost as low in 1993–95, and in 2005–07. The realized volatility of the S&P 500 is as low as it’s been in half a century.

What do you think is causing it? Is it likely to be related to political factors or something else?

Usually we need something to go wrong on a national or global scale to disrupt markets. We have had hurricanes and fires, but these apparently do not qualify. We have also had Trump’s confrontations with North Korea and Iran, and the continuing war and refugee crises in Syria and Iraq. Finally, we have the revolving door at the White House. It seems like an unstable environment, but markets have been remarkably sanguine, rising every month of this year (as of this writing).

Are there any historical parallels for this period? What do they suggest about what may happen next?

The 1960s were the build-up to the Vietnam War, along with dramatic social changes. In the 1990s, it was the calm before the tech bubble grew extreme at the end of the decade. The mid-2000s preceded the financial crisis of 2008. It is inevitable that something serious will eventually happen. We are waiting for the other shoe to drop. Yes, volatility will rise again!