Markets

What Does a Record Stock Market Mean?

We asked Yale SOM’s William Goetzmann, an expert on financial markets and the history of finance, what soaring stock prices say about the economy and the future of the markets.

Three Questions: Prof. Andrew Metrick on Paul Volcker’s Legacy

Paul Volcker, former chairman of the Federal Reserve, died on December 8 at age 92. Prof. Andrew Metrick reflects on Volcker’s contributions to the Fed and economic policy.

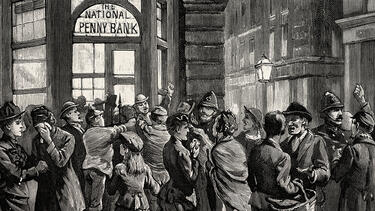

What We Talk about When We Talk about Stock Market Crashes

Yale SOM’s Robert Shiller examines how the stock market rise of the 1920s, the crash of 1929, and the Great Depression that followed came to be seen as a tale of recklessness and divine punishment.

Researchers Propose New Method to Hedge against the Risk of Climate Disaster

Markets could be a huge part of mitigating climate risk. A proposal from Yale finance faculty seeks to make that a reality.

To Prevent Financial Crises, Regulate Short-Term Debt

Yale SOM’s Gary Gorton argues that financial crises happen because short-term lending, while essential to the economy, is also vulnerable to panic when parties lose confidence in each other. In a new paper, Gorton proposes a method of regulating short-term debt and preventing future crises.

Can Antitrust Enforcement Protect Digital Consumers?

More and more of our economic and social lives are being conducted through digital channels. Economist Fiona Scott Morton talks about how effective antitrust regulation and enforcement can ensure that consumers benefit from the next killer app.

For Top Venture Capital Firms, Success Breeds Success

Most investing success is short lived, but venture capital is an exception, with top VCs beating the average year after year. A new study finds that consistent returns owe as much to a firm’s reputation and early luck as the smarts of its employees.

WeWork: What, We Worry?

Jeffrey Sonnenfeld writes that WeWork founder Adam Neumann’s sale of $700 million of his ownership indicates a lack of faith in his own company as it heads toward an IPO.

Why ‘Breaking Up’ Big Tech Probably Won’t Work

Instead, argues Yale SOM’s Fiona Scott Morton, the government should exercise its regulatory powers to promote competition.

Don’t Be Surprised by Uber’s Low-Priced IPO—It’s a Sign of Challenges to Come

According to Yale SOM’s Matthew Spiegel and Heather Tookes, an IPO is often followed by disappointing returns, not just for the newly public company but its entire industry.

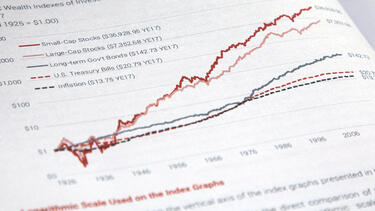

A Life in Finance: A Conversation with Prof. Roger Ibbotson

Professor Roger Ibbotson, an influential scholar and practitioner of finance for decades, sat down for a conversation with Professor William Goetzmann about his groundbreaking work on the historical returns of the stock market, his experiences as a teacher, and his current research.