Investing

Lower-Income Employees Are More Likely to Remain at 401(k) Defaults, Even If It Costs Them Money

Automatically enrolling employees in retirement plans is a powerful tool for increasing savings. But Yale SOM’s James Choi and his coauthors find that once enrolled, people with lower incomes are more likely to remain at default contribution rates, even if they aren’t optimal.

Why Aren’t Women Saving Enough for Retirement?

TIAA’s chief income strategist says while the retirement system appears to be gender neutral, it is putting women at a disadvantage.

Should You Invest in Uncertain Environments?

A focus on fundamentals can reveal opportunities in the Middle East, despite conflict, political upheaval, and economic uncertainty.

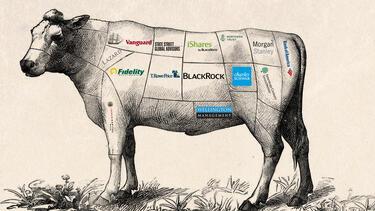

What Happens When the Same Investors Own Everything?

Diversification means that in many industries, companies are owned by an overlapping set of investors, reducing their incentive to compete.

How Should Nonprofits Invest?

Sandra Urie ’85 of Cambridge Associates talks about helping clients find the right level of risk.

Can You Get Higher Returns from Low-Risk Stocks?

The concept of high-risk, high-return is a bedrock belief in finance, confirmed by decades of empirical data. But when Prof. Roger Ibbotson dug deeper into the data, things started to look a little different.

Coworkers Affect Retirement Savings Rates

Investment companies including Fidelity, Putnam Investments, and Voya Financial are rolling out tools that tell investors how their retirement savings compare to those of their peers. This social comparison is intended to motivate investors to increase their savings; however, new research shows that it can have the opposite effect.

Why Do Our Peers’ Financial Decisions Affect Our Own?

The choices we make—the cars we drive, the neighborhoods we live in, the gyms we join—are influenced by our social networks, the people we surround ourselves with. Our financial choices are no exception. While thousands of studies have examined peer effects, a new study co-authored by Florian Ederer, assistant professor of economics, is the first to clearly identify the two channels of social influence—social learning and social utility—that explain why our peers’ financial decisions affect our own.

Is Smart Beta Really So Smart?

Smart beta is the hot thing in investing strategies, marketed as a new way to diversify and reduce risk. But Eugene Podkaminer ’01 argues that common smart beta strategies recycle long-established methods and likely aren’t the most efficient way to achieve those goals.

Big Box Retailers Squeeze Smaller Suppliers by Borrowing from Them

Large, investment-grade companies such as Walmart and Home Depot that can easily borrow money in the capital markets often receive financing from their much smaller, credit-constrained suppliers. A new study examines the effects of this pattern of financing and finds that it squeezes small suppliers, creating a cash shortfall and causing them to cut back on capital investments.

How Do You Invest in a Changing China?

Lei Zhang ’02 has been one of the most successful investors in China during a time of unprecedented change. In a conversation with Yale’s Stephen Roach, he talked about rapid shifts in China’s business and culture, the birth of a consumer class, the Chinese innovation model, and the outmoded views of the country that remain prevalent in the West.