A Life in Finance: A Conversation with Prof. Roger Ibbotson

Professor Roger Ibbotson, an influential scholar and practitioner of finance for decades, sat down for a conversation with Professor William Goetzmann about his groundbreaking work on the historical returns of the stock market, his experiences as a teacher, and his current research.

Three Questions: Prof. Roger Ibbotson on Low Volatility

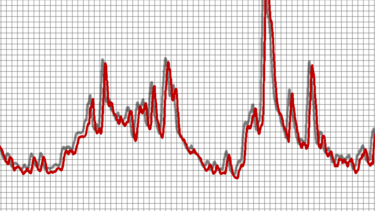

Despite political upheaval, the U.S. stock market has seen unusually low volatility. We asked Roger Ibbotson why.

Should Investors Look for Stocks with Momentum?

Research by Yale SOM’s Roger Ibbotson suggests that accelerating stocks are prone to sharp reversals.

Can You Get Higher Returns from Low-Risk Stocks?

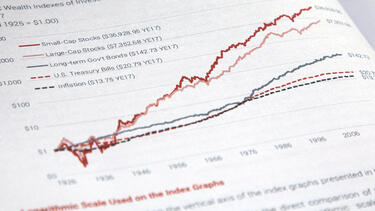

The concept of high-risk, high-return is a bedrock belief in finance, confirmed by decades of empirical data. But when Prof. Roger Ibbotson dug deeper into the data, things started to look a little different.

How Does Your Theory of Markets Shape Your Portfolio?

Investors put financial theory into practice every day. How efficient are markets? Can market participants advantageously match their capabilities to the right investments or leverage an information advantage? A panel of asset managers discusses how they see the theories playing out in real markets.

Why does market volatility matter?

Market volatility has been at near-record levels in recent months, as investors respond to the uncertainty in Europe. Roger Ibbotson takes a historical perspective and argues that volatility, while frightening for individuals, can play an important role in the economy.